Download form and document related to RMCD. In Malaysia a person who is registered under the Goods and Services Tax Act 201X is known as a registered person.

Malaysia Sst Sales And Service Tax A Complete Guide

Web You have been successfully logged out.

. Web You may also drop the refund form in the mail box located near the GST Customs Verification Counter airside before departing from Malaysia. You have a 2. Web Report all supplies made in the last taxable period and pay the GST due and payable relating to those supplies.

Web Steps To Cancel GST Online Registration On The GST Portal. Web With the improvement in Malaysias economy investors from other countries will want to invest in Malaysias market bringing more financial diversity to Malaysia. Web To close your GSTHST account you will need to complete Form RC145 Request to Close Business Number Accounts BN and send it to your tax services office.

And Claim input tax that was not claimed before 1 September. All business and accounting records relating to GST transactions are to be kept in Bahasa Melayu or English for a period of seven 7 years. Web Total annual expenses RM3120 Failing to submit Annual Return and Audited Accounts to SSM will result in fine and penalty charged to the Company and to directors personally.

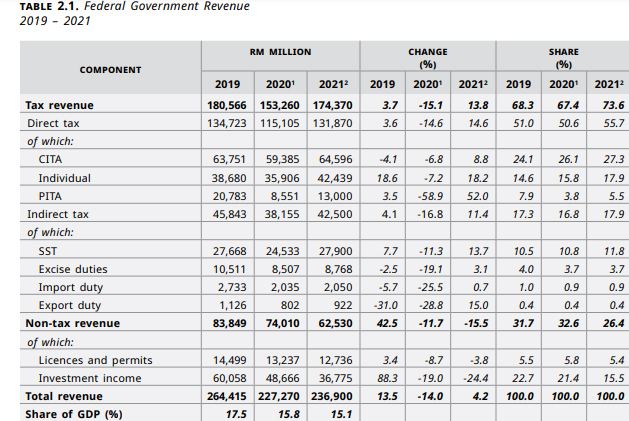

Web The Royal Malaysian Customs Department RMCD has already commenced GST closure audits even arranging for tax professionals to conduct some audits for and on their. Log in with your credentials. Unlike the present sales tax or service tax which is a single stage tax GST is a multi-stage tax.

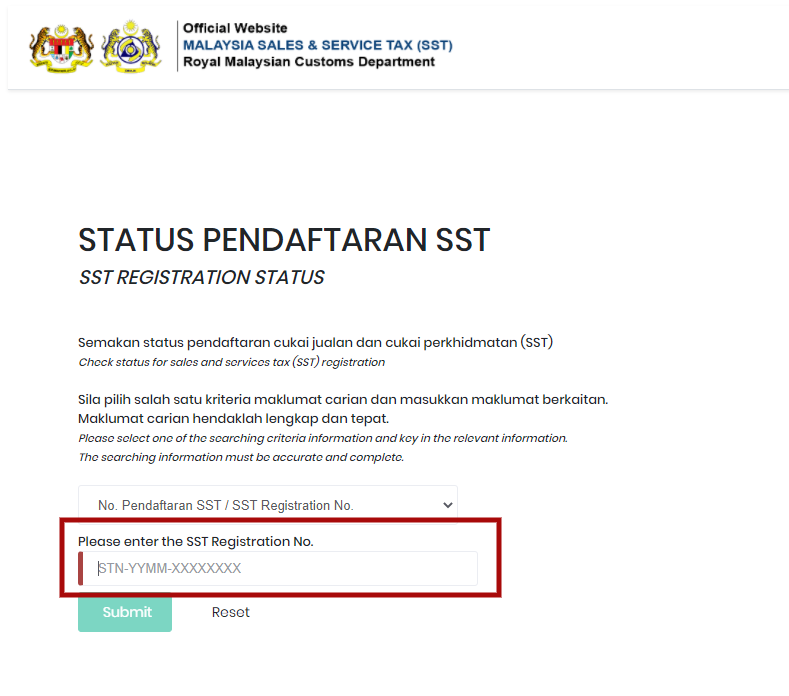

You may now close this window. If you wish to apply for the SST Deregistration process you will need to provide a letter of. Web Goods and Services Tax or GST is a consumption tax based on value-added concept.

Account for GST on taxable supplies made and received ie. Web Seal the validated original refund form in an envelope given to the tourist at the Approved Outlet and post it to the Approved Refund Agent to process the GST refund within 2. Web Frequently Asked Questions FAQs on Malaysia Goods and Services Tax GST The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the.

Click Here to Start Over. Output tax and input tax. Web solely on a cash payment basis.

Frequently login to your account in TAP to check if Customs has sent any communication in respect of the refund. Malaysian Goods and Services Tax GST is similar to Valued Added Tax VAT in other countries and is a new. Web The date you need to do this by depends on your filing frequency.

Close Information you need to close deregister your GSTHST account When you are ready to close deregister your GSTHST account you. Web So what can you do to manage your GST refund. Your final return needs to cover your taxable activity between the first and last dates of your taxable period.

Web Once you make the decision to close a GST account you need to have the following information. Web If you would like to close your business you may also submit an SST Deregistration request. Any refund of tax may be offset against other.

Web Malaysian Goods And Services Tax GST Guides. Segala maklumat sedia ada adalah. Web A registered person must comply with the requirements under GST legislation as follows.

Go to the official portal of GST. Web GST shall be levied and charged on the taxable supply of goods and services. The business number The legal name of the business The effective date of.

Web Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. Web For tracking the status of your GST registration cancellation. Now click on the Services tab and.

Web MALAYSIA GOODS SERVICES TAX GST Royal Malaysian Customs Department Not everything gets taxed basic necessities are still free of GST TAP TAXPAYER ACCESS.

Gst In Malaysia Will It Return After Being Abolished In 2018

Malaysia Gst Guide For Businesses

Sst Vs Gst How Do They Work Expatgo

Notice Gst Zero Rated Effective On June 2018 Enagic Malaysia Sdn Bhd

Tax Transaction Listing Web Based Online Accounting Software Malaysia Online Accounting So Online Accounting Software Accounting Software Online Accounting

Malaysia Sst Sales And Service Tax A Complete Guide

How To Get Gst Tax Refund Before Leaving Singapore Changi Airport Or Cruise Terminal Understand What Is Gst Sal Singapore Changi Airport Singapore Travel Tips

Tax Transaction Listing Web Based Online Accounting Software Malaysia Online Accounting So Online Accounting Software Accounting Software Online Accounting

Flipkart Seller Hub Integration With Gst Accounting Software Eztax Accounting Software Accounting Create Invoice

Gst In Malaysia Will It Return After Being Abolished In 2018

Pdf Goods And Services Tax Gst The Importance Of Comprehension Towards Achieving The Desired Awareness Among Malaysian

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Pdf The Impacts Of Goods And Services Tax Gst On Middle Income Earners In Malaysia Zulaika Nadhirah Academia Edu

Cipla Q4 Mahindra Palmoil Crudeoil Gst Taxation Services Audit And Assurance It Consultin Accounting Services Secretarial Services Consulting Business

Pdf Public Acceptance And Compliance On Goods And Services Tax Gst Implementation A Case Study Of Malaysia

Asian Diver Magazine Digital Natural Branding Diver Digital